Bank Alfalah, a prominent player in Pakistan’s banking landscape, proudly introduces Alfa WhatsApp, an innovative feature poised to reshape the banking experience for users. This groundbreaking addition transforms WhatsApp into a dynamic financial hub, making banking interactions as effortless as chatting with a friend.

Alfa WhatsApp opens up a realm of possibilities, allowing users to seamlessly transfer funds within Bank Alfalah accounts and to accounts in other banks directly through WhatsApp. Beyond its convenience, this feature champions financial inclusivity and streamlines the management of diverse portfolios. Serving as an all-in-one financial command center, Alfa WhatsApp consolidates various services within the familiar interface, simplifying financial tasks for users.

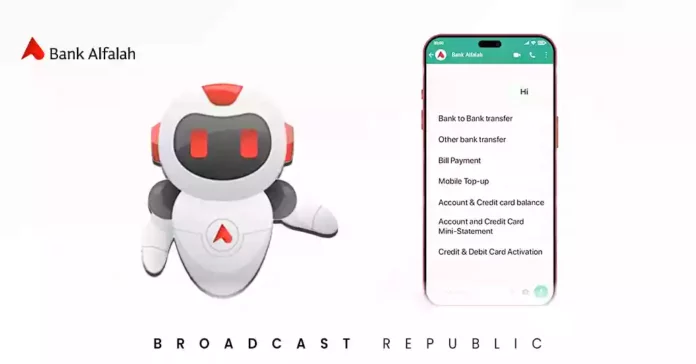

Users can enjoy the following features within Alfa WhatsApp:

- Bank to Bank transfer

- Other bank transfer

- Bill Payment

- Mobile Top-up

- Account and credit card balance

- Account and Credit Card Mini-Statement

- Credit & Debit Card Activation

Bank Alfalah ensures secure transactions through robust authentication protocols, providing users with peace of mind. This feature is thoughtfully designed to cater to both digital banking veterans and newcomers, promising a hassle-free experience for all.

Muhammad Yahya Khan, Group Head Digital Banking Group at Bank Alfalah, emphasized, “Alfa WhatsApp is not just a feature; it’s a statement. Bank Alfalah is at the forefront of the digital banking revolution, seamlessly integrating financial transactions into everyday lifestyles.”

Embarking on the financial journey with Alfa WhatsApp is as simple as sending a message on Bank Alfalah WhatsApp at 021-111-225-111. Users can type ‘7’ in the main menu to choose ‘Transact,’ unlocking seamless banking at their fingertips.

With Alfa WhatsApp, Bank Alfalah blurs the lines between banking and lifestyle, ushering in a new era of financial convenience that aligns with the dynamic needs of today’s users.