Samsung has launched two credit cards in India, entering a crowded category where more than 50 companies are fiercely competing for consumers’ attention in the world’s second-largest internet market.

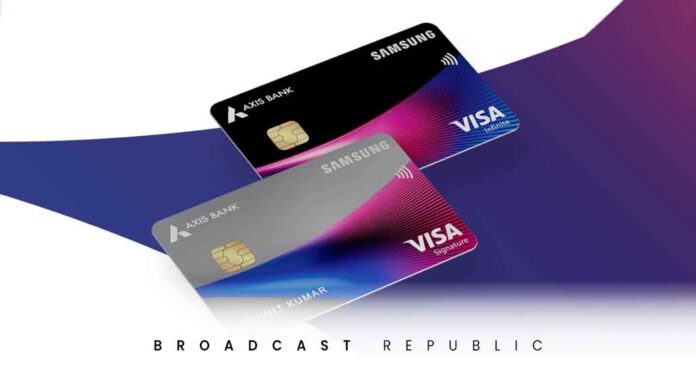

The South Korean giant said it has tied up with Mumbai-based Axis Bank and global payment processor Visa to launch what it calls the Samsung Axis Bank Credit Card. Consumers who buy Samsung products and services through one of the cards will get 10 percent cashback “for a whole year,” company executives said at an event in New Delhi.

(The Signature card has a monthly limit of INR 2,500 ($31), while the Infinite card extends this limit four times. Cashback is limited to INR 10,000 ($123) per year on the Signature card and INR 20,000 ($246) on the Infinite tab.)

Samsung, India’s second largest smartphone vendor, said it will also offer customers “exciting” credit card financing options. The cards are specifically aimed at serving consumers in smaller Indian cities, executives said.

While the space Samsung is entering is crowded, the opportunity is undeniably large. Indian banks have issued more than a billion debit cards to customers in the country, but according to industry estimates, fewer than 25 million unique individuals in the country have a credit card.

Customers will earn rewards for spending through their cards and access offers from local businesses including delivery service Zomato, fashion e-commerce Myntra, online pharmacy Tata’s 1mg, grocer Bigbasket and Urban Company.

Monday’s announcement underscores a growing push by smartphone makers to expand their services. Chinese giant Xiaomi, which dominates the country’s smartphone market, launched a UPI-enabled payment service in India in 2019 and started lending to customers last year. (Samsung launched its UPI-powered payment service Samsung Pay in India in 2017.)

Co-branded cards are generally a “win-win for the bank, partner brand and customers” as they allow experienced brand users to earn higher benefits as they spend more with the brand.

“The brand gets more loyalty from its users, while the bank obviously benefits from gaining access to a different customer group, with the customer acquisition itself coming from the brand or loyal brand users,” a Bengaluru-based fintech executive told TechCrunch. request anonymity when commenting on another company’s products.

The annual fee for the Signature card is $6.13 before tax, while the Infinite card charges 10 times that. The company said it will soon begin accepting customer applications for the cards.

“At Samsung, we believe in transforming the lives of our consumers through the power of innovation. The Samsung Axis Bank Credit Card from Visa is our next big India-specific innovation that will transform the way our customers buy Samsung products and spend on services through a range of cutting-edge features. We are excited to put control in the hands of our consumers,” Ken Kang, president and CEO of Samsung South-West Asia, said in a statement.